How Inflation Affects Your Taxes

In 2022, Americans saw the biggest increase since 1981 in inflation, a whopping 9.1%.

This is a pain that’s felt by every citizen across the country, from the groceries they buy to the gas they put into their cars. However, these everyday purchases aren’t the only places that Americans will feel the effects of inflation.

Inflation also affects your taxes as well. In this article, we’ll cover the relationship between inflation and taxes and what it means for you.

Keep reading to learn more.

How Inflation and Taxes Connect

Before we jump into the nitty gritty of how inflation might affect your upcoming tax returns, it’s important to understand what inflation is and why it’s happening now.

Inflation refers to the increase in the price of goods and services all over the world. This is also affected by the decreasing value of money.

You might have heard an older person say something along the lines of “back in my day, you could buy a carton of milk for a quarter.” That’s inflation at work — and nowadays we’re seeing it skyrocket with our own eyes.

Although several factors drive inflation, the record-breaking inflation that we’re seeing in 2022 was primarily driven by the COVID-19 pandemic. A few factors that were directly impacted by the pandemic include:

- Supply chain issues and shortages

- Increased wages

- Soaring demand for goods and real estate

- Strong job growth

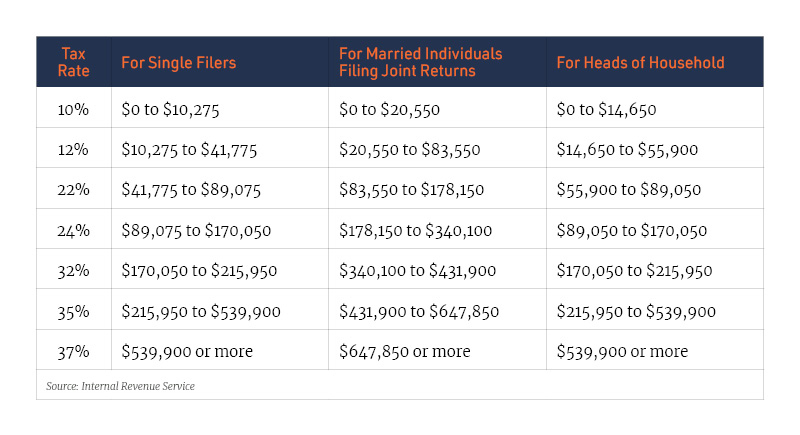

But what about how tax cuts and inflation are linked? Even with the high fluctuation of inflation, the seven federal income tax rate brackets do not change. Those rates are:

However, the federal income tax brackets that are linked to those rates are adjusted for inflation every single year. So because we experienced high levels of inflation this year, you might feel like you got a tax break next year even if your taxable income stays the same. This happens because you end up in a lower tax bracket, ultimately meaning you get a lower tax rate as well.

Let’s take a look at an example of a taxpayer filing single.

In 2022, those that file a taxable income between $41,776 to $89,075 are in the 22% federal income tax bracket. But in 2021, that same bracket applied to anyone filing single with taxable income between $40,526 to $86,375.

This means that if you are single and filed a taxable income of $41,000 in the years 2021 and 2022, you moved from the 22% federal tax bracket to the 12% bracket. That tax bracket in 2022 includes people who make $10,276 to $41,775.

The longer high inflation sticks around, the more favorable it can be for people trying to “jump” brackets. It is also helpful in avoiding “bracket creep,” which is essentially the same thing but the opposite: when their income stays the same, but they end up in a higher tax bracket.

The relationship between taxes and inflation are closely intertwined.

The Standard Deduction

The standard deduction also takes inflation levels into account, which can help reduce your tax bill if you don’t claim itemized deductions.

The IRS has increased the standard deduction for each of the different filing statuses (single, married filing jointly, head of household, etc.) in 2022 by more than 3%, which is much higher than the increase in 2021.

This means that the standard deduction for a single filer is $12,950, which is $450 more than it was in 2021.

For a married couple filing jointly, it rose by $800 from $25,100 to $25,900.

401(k) and IRA Contribution Limits

Another important factor that inflation affects is your IRA contribution limit. This means that if you have a workplace retirement account that you contribute to, you can add even more money to it each year — especially when inflation is high. This can be a huge advantage, as these accounts already reduce your taxable income.

The contribution limit for 401(k) plans has risen by $1,000 from the previous tax year up to $20,500. If you’re over 50, you can contribute another $6,500 in “catch-up” contributions., which adds up to $27,000. Solo 401(k) contribution limits have risen as well. The maximum contribution went from $38,500 in 2021 to $40,500 in 2022.

However, IRA contribution limits didn’t increase for individual retirement accounts. The limit has remained at $6,000 in 2022 for both Roth IRAs and traditional accounts.

The good news is that the income ceilings for IRA contributions adjust up for inflation. The limit is now up to $214,000 (from $208,000) for joint filers and $144,000 (from $140,000) for single filers.

Capital Gains and Depreciation

Not only does inflation hit you in the wallet when it comes to everyday goods like food, toiletries, and gas, but it also significantly raises the cost of capital assets like cars and houses. Because capital gains are not indexed for inflation, the losses you gain multiply during periods of high inflation.

But when you pay taxes on capital gains, the income thresholds for long-term capital gains tax rates adjust for inflation. Similarly to paying normal tax rates, you might be able to avoid bracket creep or even drop to a lower tax bracket if your income stays the same. This might be able to keep you out of the 20% capital gains tax bracket.

Another factor that comes into play during periods of high inflation is the value of depreciation deductions. In 2022, the IRS raised depreciation limits for cars. For example, the first-year depreciation increased from $18,200 to $19,200 in the first tax year of use.

Health Expense Accounts

For people that enroll in a high-deductible health plan, an HSA, or a health savings account, you can get a tax-free way to pay for any health expenses and contribute more to your retirement savings.

This tax-deductible amount that you contribute to your HSA is also adjusted for inflation. In 2022, the contribution limit is $3,650 for individuals and $7,300 for families.

Again, those that are 55 or older get another $1,000 as a “catch-up” contribution, which makes it $4,650 for individuals and $8,300 for families.

Because of the high levels of inflation, HSA contribution limits will increase by $200 for individuals and $450 for families in 2023.

Social Security COLA 2023

Although income limits for taxing Social Security benefits aren’t adjusted for inflation, the retirement benefits from your Social Security do get a cost-of-living-adjustment (COLA).

The adjustment for 2022 has risen to 5.9% — the highest it has ever been. This could increase again in 2023. Depending on your other taxable income, up to 85% of your Social Security could be taxable.

Right now, people are on the edge of their seats to know what the Social Security COLA will be in 2023. It will be announced in October, and people are expecting a substantial increase.

Child Tax Credit, Adoption Credit, and Earned Income Tax Credit

There are several other tax provisions affected by inflation. Let’s take a look at a few:

The Child Tax Credit — Right now, the Child Tax Credit of $2,000 is not adjusted for inflation. However, the refundable portion of it is. It has increased by $100 to $1,500 in 2022.

The Adoption Credit — For those adopting a child, the maximum credit in 2022 for adoption expenses have increased from $14,440 to $14,890.

Earned Income Tax Credit — The Earned Income Tax Credit was created to help lower tax liability for low-to-moderate income families. Several factors of the EITC adjust for inflation, including the phase-out ranges, maximum credit amounts, and investment income limits.

Many different categories have different EITC amounts, so make sure to carefully calculate the amount or reach out to a tax professional to file your income tax and inflation rates correctly.

Proposed Inflation Relief

In the Senate, a new bill to further adjust tax credits for inflation to help low-to-moderate income taxpayers was just introduced. Although it has not been passed yet, keep in mind that more changes could be coming.

If the plan is approved (the Family and Community Inflation Relief act), several popular tax credits could adjust for inflation. These include:

- The child tax credit

- The non-child-dependent credit

- The American Opportunity tax credit

- The Lifetime Learning credit

Other tax deductions for charitable mileage and student loan interest would also adjust for inflation.

Not All Tax Provisions Will Adjust for Inflation

Although several new provisions are coming, many of them will remain the same every year.

For example, the 3.8% surcharge on investment income that starts for gross incomes over $200,000 for individual filers and $250,000 for couples has not been adjusted.

The $3,000 limit for capital loss deductions has been the same amount for almost 30 years, even as inflation continues to skyrocket.

Be Prepared for Your Next Tax Season

That’s everything you need to know about how inflation and taxes will be affected in 2022 and into 2023. Although it isn’t easy for anyone when inflation starts soaring, you can mitigate the pain if you have the right knowledge and support around you.

If you’re a physician looking for full-service tax preparation, documentation, and proactive strategies that can help you save a significant amount on your taxes, start saving with us today!