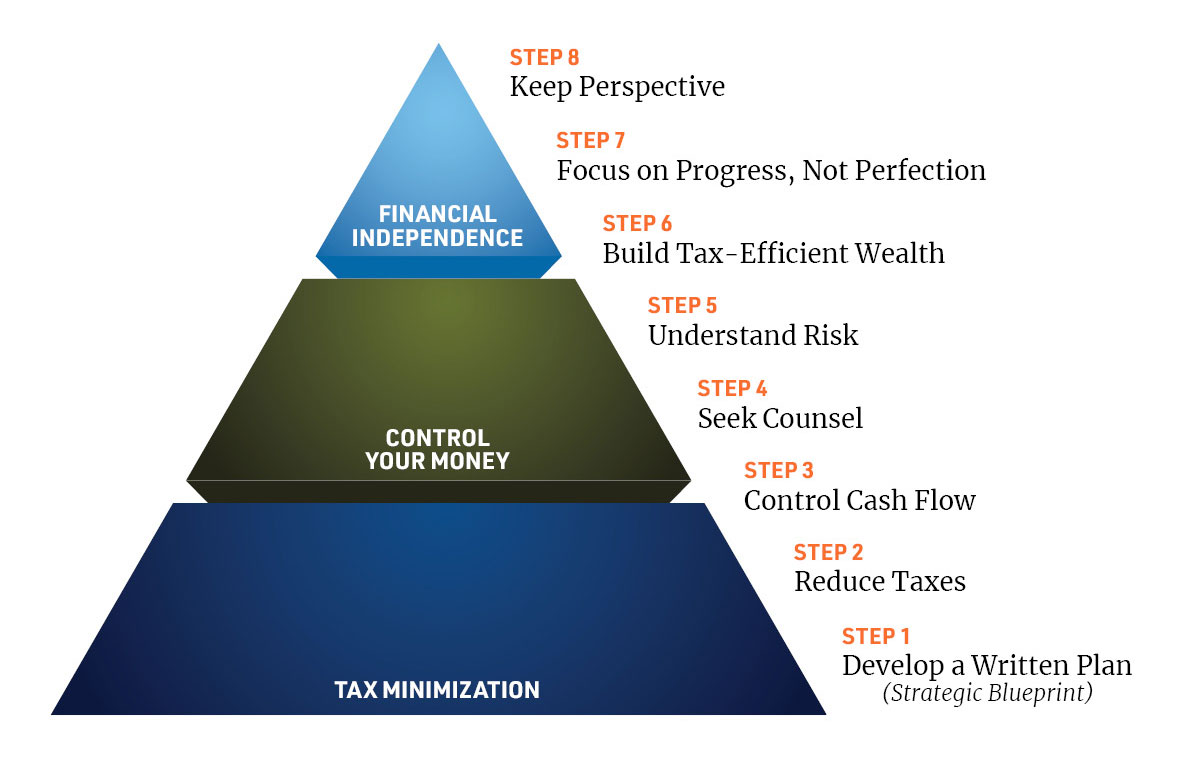

Keep More of What You Earn Our Strategic Wealth System

As a Physician Tax Solutions client, you'll have a team of professionals behind you. Our goal is simple - We help you achieve financial freedom sooner so that can enjoy retirement and leave a legacy.

This is a look at our Strategic Wealth System, as featured in our founder's latest book The Richest Doctor: A Modern Parable of Financial Independence.

Tax Advice and More... Read the Latest from Our Blog

Tax Planning Services Near Me: Why “Near Me” Usually Means Remote (If You’re a High Earner)

Get David Auer's Latest Book

The Richest Doctor:

A Modern Guide to Financial Independence

If you are a physician seeking a better way toward retirement and financial freedom, The Richest Doctor is for you!

The new anecdotal work from Physician Tax Solutions' founder, David Auer, serves as a step-by-step narrative of how physicians and high-income professionals can become financially independent faster through proactive tax planning and proven investing methods.

The Richest Doctor follows four emergency room physicians after their residency.

Each physician works with a proactive certified public accountant, Will, to reduce their tax burden and use tax savings to grow their wealth. Reconnecting on a regular basis, the friends compare how their career decisions move them closer to financial independence and a “rich” legacy. Rich, in this case, means a robust life, caring for family and friends, and building wealth to accomplish important goals.

The Richest Doctor was published in April 2022 and quickly became the #1 New Release in Amazon's Taxation and Personal Taxation book categories.

Right now, you can get the first two chapters delivered to your inbox for free via www.therichestdoctor.com website.