Posts Tagged ‘tax savings’

Regret That Loan? Here’s How to Fix It

Most people don’t take out a loan thinking they’ll regret it. But then reality kicks in. The interest rate creeps up, the payments start to sting, or maybe the purpose of the loan no longer makes sense. Whether it’s a personal loan, business loan, or something in between—if you’re feeling stuck with one, you’re not…

Read MoreHow Businesses—New and Old—Can Save More on Taxes

Every business—whether it’s been around for decades or just launched last month—has something in common: taxes. Taxes don’t care if you’re bootstrapping in year one or leading a multi-million-dollar operation. They show up every year, every quarter, without fail. And if you’re not intentional about managing them, they’ll quietly drain resources you could’ve put to…

Read MoreCould You Pay Less Tax Under Trump’s One Big Beautiful Bill?

Well, here we are. Trump’s “One Big Beautiful Bill” is now the law of the land. I have to admit—just a couple years ago, I’d have bet this was more political rally talk than a real piece of legislation. But Congress actually passed it, and it’s… big. And kind of beautiful, depending on who you…

Read MoreSaving Money When Your Insurance Premiums Go Up

I remember opening my renewal notice once and blinking twice, thinking my eyes were playing tricks. My car insurance premium had jumped almost 20%. No new claims. No new tickets. Just… up. Sound familiar? If your insurance costs are rising, you’re not alone. It’s happening everywhere—from auto and homeowners insurance to health coverage. Let’s unpack…

Read MoreManaging Your Finances Despite Trump Tariffs

The impact of tariffs, particularly those implemented during the Trump administration, has been felt by businesses and individuals alike. Whether you’re a business owner, an investor, or a consumer, these tariffs can affect everything from product prices to investment strategies. This blog will walk you through how to manage your finances during this turbulent time,…

Read MoreCelebrating Memorial Day with a Roth Conversion? Here’s When It Makes Sense

Memorial Day marks more than just the start of summer. It’s also a smart checkpoint in the year to revisit your finances — especially your retirement strategy. One question you might be asking:Should I do a Roth conversion now? The answer depends on timing, income, tax projections, and your long-term goals. What Is a Roth…

Read MoreStrategies to Reduce Your Tax Liability

Taxes can feel like a heavy burden, but there are many ways you can reduce your tax liability if you take the right steps. Whether you’re a business owner, a high-income earner, or just someone looking to make the most of your finances, understanding tax-saving strategies is crucial. In this guide, we’ll break down the…

Read MoreWhen Does a Roth Conversion Make Financial Sense?

A Roth conversion lets you shift money from a pre-tax retirement account into a Roth IRA. The trade-off: you pay taxes now in exchange for tax-free withdrawals later. Done strategically, a Roth conversion can lower your lifetime tax bill, reduce required minimum distributions (RMDs), and give you more control over retirement income. But the benefits…

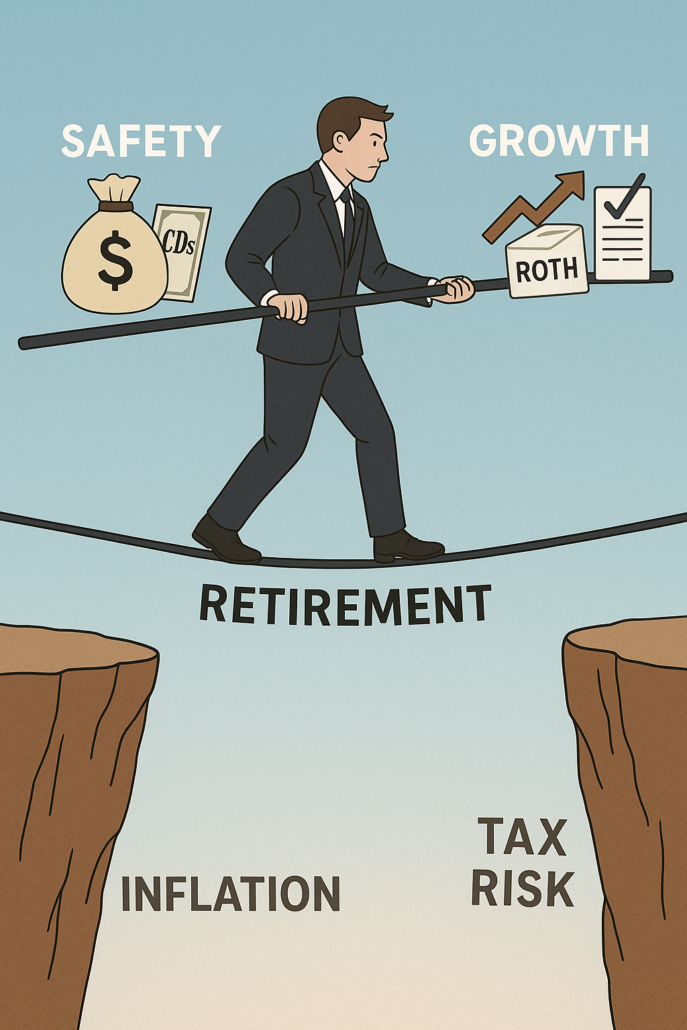

Read More4 Signs You’re Playing It Too Safe with Your Retirement

Playing it safe in retirement planning sounds wise. But being too cautious can quietly erode your wealth. Many investors, especially high-income professionals, overcorrect for risk—only to find themselves underprepared for rising costs, inflation, and tax burdens. If you’re too focused on protecting what you have, you might be missing out on sustainable growth, efficient tax…

Read MoreHow to Save More Without Sacrificing Enjoyment

Saving money should not feel like punishment. You deserve to enjoy your life today while building financial security for the future. With the right strategies, you can save more without cutting out what makes life meaningful. Here’s how you can make smart financial moves — and still have fun along the way. How to Save…

Read More